LendAmi Borrower and Lender Survey

When it comes to loans between family and friends, both borrowers and lenders share feelings of discomfort

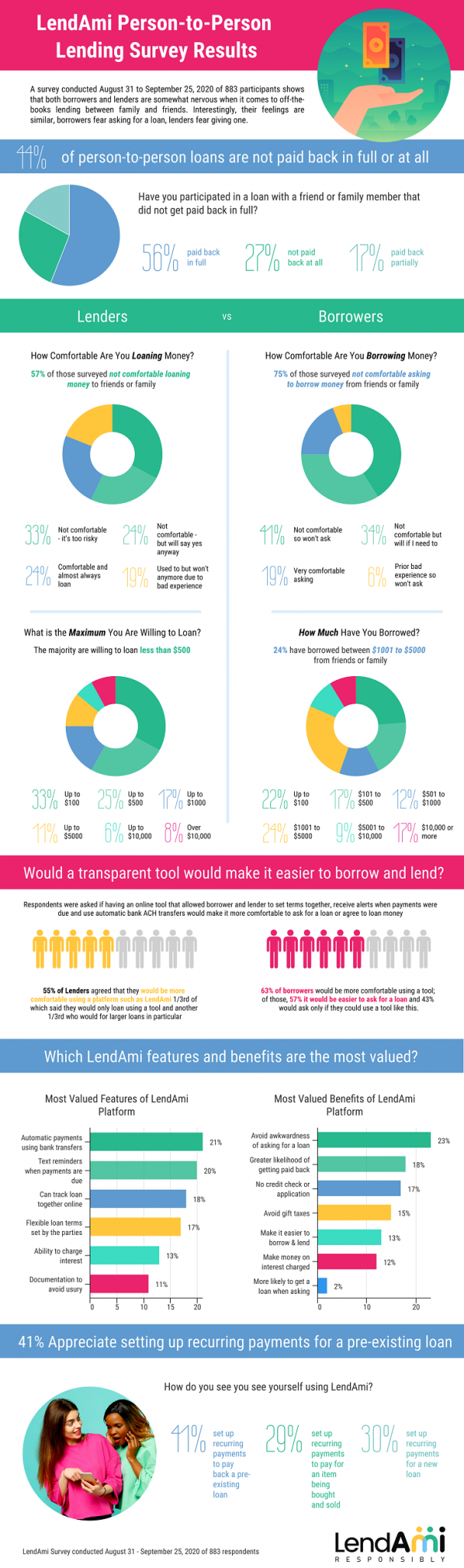

A survey conducted from August 31 to September 25 of 883 participants shows that both borrowers and lenders are somewhat nervous when it comes to off-the-books lending between family and friends. Borrowers’ greatest concern is the discomfort of asking for a loan and for lenders, it’s not getting paid back.

When asked if using a transparent online platform to mutually set loan terms, track the loan progress together online and use bank ACH transfers to make automatic payments on a schedule 55% of lenders agreed that they would be more comfortable using a platform such as LendAmi including 33% who said they would only loan using a tool and another 33% who would for larger loans in particular. On the borrower side, 63% said they would be more comfortable using a tool and, of those, 57% it would be easier to ask for a loan and 43% would ask only if they could use a tool like this.

Avoiding Awkwardness

It seems that removing the awkwardness out of asking for a loan as well asking for payments is mitigated when a user-friendly platform is in the middle helping to facilitate the transaction in a safe, secure and responsible manner. For lenders and borrowers, the features most valued are automatic payments using bank transfers (21%), text reminders when payments are due (20%) and the ability to track the loan online (18%).

The most valued benefits using LendAmi are avoiding the awkwardness of asking for a loan (23%), greater likelihood of getting paid back (18%) and no credit check or application required (17%).

Recurring Payments Take Several Forms

Borrowers and lenders also envision multiple use cases for setting up recurring payments with friends and family. Besides setting up new loans between parties, other use cases are deemed important. 41% of respondents indicated that setting up transparent, recurring payments was important to them along with 29% who see value in setting up recurring payments to pay back a pre-existing loan that has gone of track.

Additional Highlights:

- 44% of loans transacted are not paid back in full or at all

- 33% of lenders are not comfortable loaning money because it’s too risky

- 41% of borrowers are not comfortable asking for a loan so won’t bother

- Lenders keep it small: 33% of lenders willing to lend only up to $100 and an additional 25% up to $500

- 24% of borrowers borrowed between $1000 – $5000 and 17% over $10,000

LendAmi Borrower and Lender Survey Infographic